Software company Enertiv is bringing sustainability to commercial real estate, enabling widespread measures to help decarbonize one of the biggest contributors to climate change.

With its newest funding round of $9 million, operational intelligence platform Enertiv is aiming to play “a leading role” in the decarbonization of commercial real estate, the company says.

The latest round, co-led by Commonweal Ventures and GroundBreak Ventures, brings Enertiv’s funding to more than $16 million with the goal of helping the real estate industry reduce its carbon footprint.

“We’re the first generation that’s feeling the effects of global warming and the last that will be able to address the problem,” Connell McGill, CEO of Enertiv said in a statement.

Real estate’s carbon footprint

“As the commercial real estate industry races to reduce carbon emissions and comply with local and state climate regulations, building owners need the right tools in hand,” said Nate Loewentheil, Founder and Managing Partner of Commonweal Ventures.

Building operations are a big problem for the climate, according to Enertiv, accounting for 28 percent of all emissions. “As a major carbon emitter, the real estate industry simply has to take action now. To achieve net-zero targets, measuring and reporting carbon emissions is not nearly enough. Owners and operators absolutely need to benchmark, report and set targets, but they also need to act, and act fast,” McGill added.

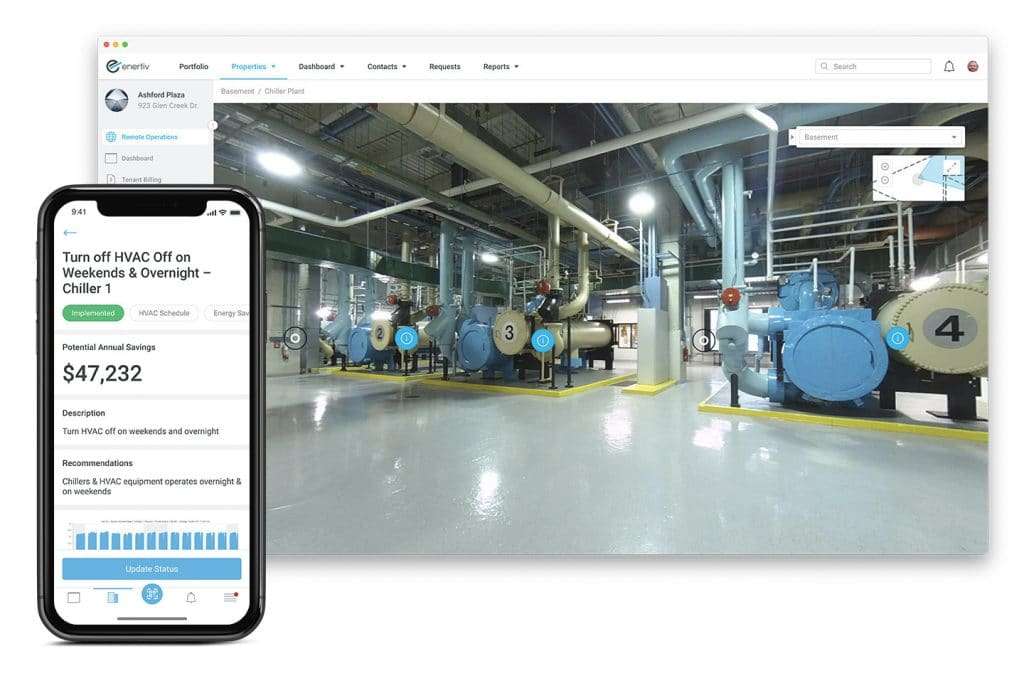

Enertiv’s software collects data from its customers and uses it to generate insights on “when, where, and how” to reduce energy and save money at the building and portfolio level, says Loewentheil. “Enertiv’s products meet customers where they are, addressing immediate operational challenges, while laying the groundwork for future decarbonization investments.”

Scott Kaplanis, Managing Partner of GroundBreak Ventures, says Enertiv’s platform delivers “no-nonsense solutions for building owners and operators with a real commitment to using data to improve operations, accelerate NOI and minimize environmental impact.”

Enertiv’s focus is on helping owners and operators to reduce their footprints. The new funding will help the company develop the world’s first end-to-end ESG solution, which it says is “built to support a transition from portfolio-level benchmarking, to achieving quantifiable carbon reductions.”

The ESG module extends beyond “utility meter data” according to the platform, and provides its customers with “radical transparency” into a more holistic view of operations including environmental health and safety as well as resource consumption.

Funding is also going to support the expansion of the platform’s existing software offerings and enhance its AI algorithms.

Automating climate action

“Enertiv is about having access to granular data that identifies where meaningful changes can be made day to day,” says McGill. “Enertiv serves as a centralized platform for all ESG reporting, as well as providing real estate operators with the solutions that they need to reduce carbon emissions and optimize performance at the asset level. This latest raise will enable us to further develop our capabilities in this area, as we look to meet the growing demand for our technology.”

According to Enertiv, its tech is used across the management of more than 100 million square feet of commercial real estate, increasing net operating income by assisting with expense controls and enabling owners and operators to “do more with less” by the digitization of operations. This, the company says, results in “unprecedented visibility into ESG performance and critical infrastructure across entire portfolios.”

To date, the company has captured more than 18 billion hours of asset and equipment level data with a savings of 21 cents per square foot—or nearly $500 million in net asset value.

The funding raise comes on the heels of a recent report that found sustainability is a priority for luxury homebuyers as well. A reshuffling of priorities following the covid pandemic has seen a spike in interest for sustainability at the forefront of design, rather than as an afterthought. It’s an ethos Enertiv is embracing as well.

“At Enertiv, we want to encourage as many owners and operators as possible to shift from measurement to action,” McGill said. “That is why we are offering our ESG module at no additional cost this year, and continually developing the tools the industry needs to tackle the climate crisis head on.”