Popular secondhand platform The RealReal has released its 2023 Luxury Consignment Report detailing a marked shift in consumer shopping behaviors.

Threats of a recession and economic uncertainty are driving shifts in secondhand shopping habits, says the 2023 Luxury Consignment Report from The RealReal.

While Gen Z and millennials continue to drive secondhand demand, particularly vintage items, there’s a trading-down shift, with consumers settling for lesser-quality goods and trendier styles instead of ultra-luxury.

“A potential recession, the climate crisis, and global unrest are all reasons that, going into 2023, consumers are making shopping decisions based on value — with 66 percent saying they shop resale primarily to get a good deal — as well as personal values,” Rati Sahi Levesque, co-CEO and President, The RealReal, said in a statement.

“We’re seeing our members do this in many different ways, from trading down ultra-luxe bags for more accessible options and buying fair condition items to express themselves through fashion and sustainable shopping practices. The value of resale is different for every person – and that’s the beauty of it,” Levesque said.

The report pulls data from The RealReal’s 30 million members and nearly as many items sold. The RealReal is the largest online marketplace for authenticated, resale luxury items.

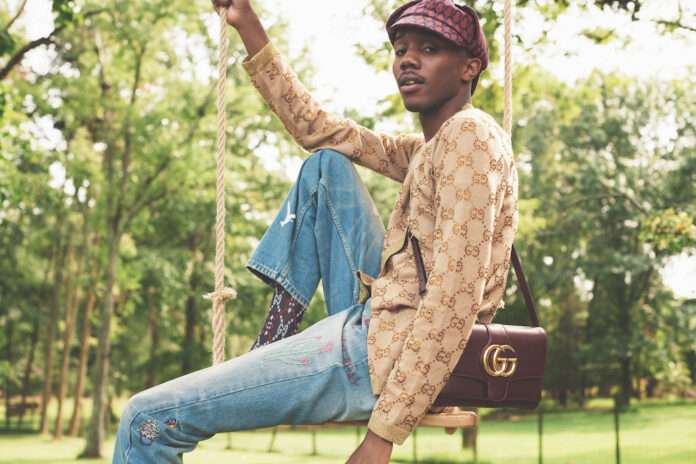

High-end luxury handbag prices began to stabilize late last year, the report notes, declining by five percent for mainstays including Louis Vuitton, Gucci, Hermès, and Chanel.

Demand for bags listed in ‘fair’ condition — items showing signs of heavy wear such as worn corners and handles, noticeable scratches, or interior wear — nearly doubled to 58 percent. Prada, Miu Miu, and Dior sales increased during that time. Demand for Prada’s Crystal Re-Edition of its 2000 mini bag was up more than 1,300 percent YoY.

“The ‘worn’ trend is about people appreciating quality items and refusing to let a few scratches get in the way of enjoying a Chanel or a Gucci bag,” said Becky Akinyode, a stylist and creative consultant with The RealReal.

While Y2K is still driving demand — women’s ready-to-wear collection from Simone Rocha climbed 635 percent — the report shows a shift toward ‘timeless classics’ including Prada (up 376 percent) and Jil Sander (up 263 percent).

“For the past year, Y2K has dominated everything, but we’re beginning to see that flow in the other direction,” said Dominik Halas, a master authenticator in vintage for The RealReal. “Demand for vintage from brands known for their couture-level tailoring is on the rise — and in a big way.”

That classic shift is carrying over across categories with pearl jewelry up as well as brooches, tailored suits, and feminine dresses. Mules and loafers are also trending; Valentino mules saw a 274 percent increase and Loew loafers increased 1,360 percent.

Re-consignment was up 52 percent among Gen-Z last year, the report notes, indicating the circular economy ethos is strongest amongst younger shoppers. Millennials still bought the most, increasing purchases by nearly 20 percent over 2021.

But once again, the smaller market segment but more affluent Gen X spent the most per person. Boomers also use the platform and consigned the highest-value items — increasing their sales of jewelry YoY.

Related on Ethos: